Third Quarter Market Review

As the Covid-19 pandemic enters its 8 month, so many questions remain unanswered.

How far are we from having a vaccine? Will there be an emergence of new Covid cases as the weather gets colder? Will states be able to effectively reopen local economies? Most importantly, when will things get back to normal?

While stocks have staged a significant rally from their late March lows, there is still quite a bit of negative sentiment and rightly so! The economy has shed hundreds of thousands of jobs this year and there are a number of industries that are in extreme distress including airlines, hospitality/lodging and energy.

So – what’s next for the U.S. economy? There are so many unknowns and it seems like such a tremendous amount of uncertainty.

Will Congress move to enact another round of stimulus in an effort to stave off a more severe recession? What about the uncertainty swirling around this election cycle? There hasn’t been a more contentious political environment in recent memory.

These unresolved questions all seem pretty important at the moment. However, will these temporary issues have a meaningful impact on a well-diversified, long term investment strategy? Of course not, but uncertainty does create increased volatility in the markets that can be unsettling for even the most seasoned investors.

During periods of market uncertainty, it is important to remind yourself of the following:

Your investment strategy is based on a customized set of circumstances and your expected cash flow requirements.

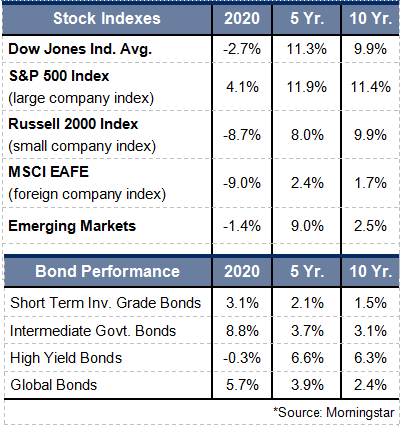

Your portfolio is much more diversified than the Dow Jones, the S&P 500, or any other commonly quoted index. As such, the performance of your portfolio will vary somewhat from these equity-based benchmarks.

You have an extended investment time horizon; therefore, day-to-day portfolio fluctuations will not have a meaningful impact on your lifestyle in retirement.

Occasional setbacks are expected, necessary and (actually) healthy. They should be approached opportunistically and with confidence.

It is our hope that as the year progresses, you will find confidence and peace of mind knowing that you have a sound investment strategy. We hope that you will not hesitate to give us a call should you have any questions!