Why Invest Globally?

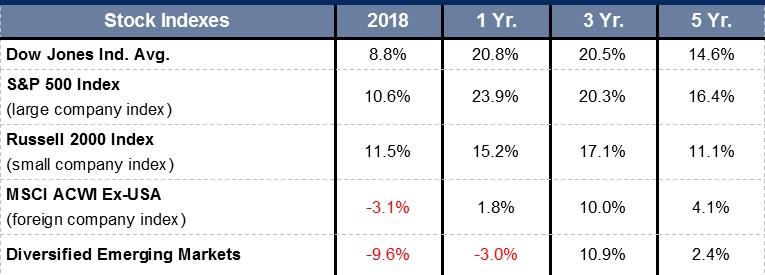

The U.S. stock market has really been on a tear! This is especially true when comparing the performance of U.S. stocks to international stocks. You will note in the table below that over the last year the S&P 500 (U.S. stocks) has outperformed its international counterpart by more than 22%! This disparity in performance becomes even more magnified when considering 10 year and 15 year performance numbers. In fact, U.S stocks have outpaced foreign stocks by about 2.5% annually for the last 15 years!

So why is it important to take a global perspective when investing for the long term?

We believe there are many compelling reasons to add international exposure to your portfolio. Of course investing in international companies adds an increased element of diversification. In fact, over extended periods of time portfolios that have both foreign and domestic stock exposure maintain higher risk-adjusted returns than those portfolios that do not.

Take Note of Personal Preferences...

While we could spend time discussing the technical reasons investing globally is important, we would suggest that instead you take note of your own personal buying preferences.

What type of car do you drive? Toyota, Subaru, Diamler, Volvo and Volkswagen are some of the most popular foreign-made brands. In foods and consumer goods, Nestlé and Uniliver are major players. Brands like Breyers, Dove, Helmann’s, Lipton, Boost, Purina, and my personal favorite KitKat are all items that your family may buy on a regular basis.

In electronics, there is Samsung (South Korea), Toshiba (Japan), Sony (Japan) and Lenovo (China). In pharmaceuticals, there is Bayer (Germany), GSK (UK), Novartis (Switzerland) and AstraZeneca (UK). The list of international headquartered companies with a global footprint can continue in any industry. Is it prudent to ignore these growth-driven companies in your portfolio?

Even though performance of many international stocks has been below historical norms of late, we believe the future is bright! Please contact our office to discuss your portfolio in more detail.