What is the biggest difference between mutual funds and exchange traded funds?

While both mutual funds and exchange traded funds (ETFs) can be effective tools when creating a diversified portfolio, it is important to understand attributes of each of these investment options.

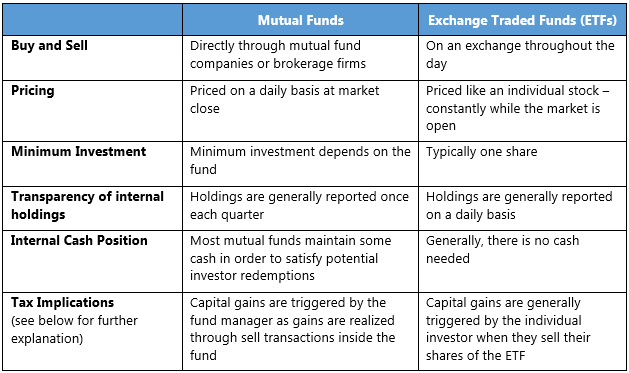

First of all there are both good/bad as well as high cost/low cost mutual funds and exchange traded funds. Therefore, investors need to be prudent and go through the proper due-diligence process when deciding on which alternative is best. The following table compares notable attributes of each:

A Comparison of Mutual Funds and Exchange Traded Funds (ETFs)

There can be a huge difference between mutual funds and ETFs when it comes to tax-efficiency…

Most mutual funds, especially “actively” managed funds, can be incredibly tax inefficient – especially compared to exchange traded funds. This is due to the fact that over time, mutual fund portfolio managers place trades within the fund - buying and selling stocks and bonds owned within the fund. Even though you as an investor have retained your position, because the mutual fund manager places trades that result in realizing capital gains within the fund – these taxable gains are distributed to you. Here is an example:

You have been a long term investor in Mutual Fund of America. Over the last several months many investors in the fund have sold their position because they are fearful of a stock market decline. To satisfy these redemptions and pay these former fund holders their money, the portfolio manager of Mutual Fund of America has to sell stocks that the fund has owned for 10 or more years resulting in substantial capital gains. These gains are then distributed (or passed through) to the remaining shareholders in the form of an end of year capital gain distribution. You will receive a 1099 form from Mutual Fund of America reporting these taxable capital gains.

The tax structure of ETFs can be much more beneficial than a mutual fund with the same investment objective. While ETFs can have capital gains distributions as well, capital gains are normally only realized when there is a “reconstitution” of the index the ETF tracks. These index reconstitutions are generally very small and generally generate negligible capital gains for most broad market based ETFs.

Using the same details from the example above, if Mutual Fund of America were an ETF and not a mutual fund, the fact that other investors exited the fund does not mean that you (a remaining shareholder) would receive a capital gain distribution. You would only be subject to capital gains when you sell your position in the fund. Keep in mind that, like mutual funds, ETFs would still receive (and be taxed on) any stock dividends or bond interest earned.

If tax-efficiency is a serious consideration, it may be best to consider utilizing exchange traded funds that employ a broad market index-based approach. However, as with mutual funds, each exchange traded fund should be evaluated and monitored over time to ensure it is suitable given your investment circumstances and risk profile.